Žurnāls Ir | Svarīgākais politikā, ekonomikā un kultūrā

Jaunākie raksti

Tuvāk pamatiem

Kādi bija latviešu folkloras pētniecības sākumi un turpmākie ceļi? Cik aktuāla tā ir mūsdienās?

Manī runā arī emocijas

Nemainot priekšstatu par Ulmaņa autoritārismu, vēsturnieks atzīst starpkaru Latvijas sakoptību un skaistumu pirms tās bojāejas. Ar Aivaru Strangu sarunājas Ineta Lipša

Sāc savu dienu ar uzticamu svarīgāko ziņu apkopojumu!

Īsi par svarīgāko ik rītu — pieraksties jaunumu vēstulei Ir Svarīgākais!

ES paplašina finansējuma pieejamību aizsardzībai: ko “miniomnibus” nozīmē Latvijai?

Eiropas regulējumi reti izraisa aizrautīgas diskusijas vai plašu sabiedrības interesi. Parasti tie tiek uzskatīti par nesaprotamu birokrātisku dokumentu mudžekli, kas šķiet radīti tikai ierēdņu un politiķu priekam.

Britu pirmatnējās takas, pauguri, kapkalni, apmetnes un vietas

Lekcija Vūlhoupas klubā Herefordā 1921. gada septembrī

Raidieraksti

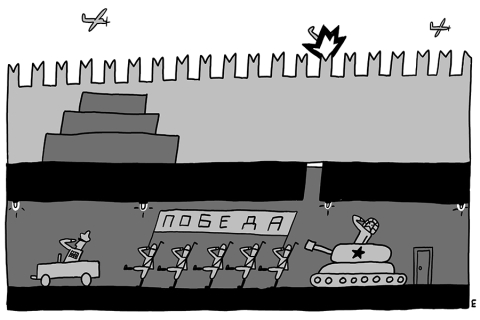

Karikatūra

Personības

Viedokļi

Recenzijas

Pētījumi

Eiropā

Bizness un ekonomika

Saulkrastu superpīrāgi

Saulkrastu uzņēmuma Superpīrāgs īpašniece Ilze Kalviša savu biznesu savulaik sāka, bruņojusies ar pavārgrāmatu un paļāvību, bez mazākās pieredzes konditorejā un visu nepieciešamo aizņemoties

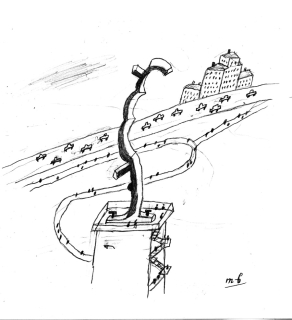

Pāļu injekcijas pamatiem

Mikropāļi ir samērā jauna būvniecības tehnoloģija, kuru Latvijā un Igaunijā jau 25 gadus attīsta Daiņa Mūsiņa uzņēmums. Savulaik četri gadi nostrādāti arī Apvienotajos Arābu Emirātos, bet tagad tuvākais mērķis ir iespiesties Lietuvas tirgū

Infrastruktūras problēmu risinātāji

Uzņēmums Carmine Red IT projektē un uzstāda IT infrastruktūru. Sākotnēji izveidots kā mākoņpakalpojumu sniedzējs, tas ir pielāgojies tirgum, kurā uzņēmumi joprojām vēlas savas iekārtas

Populārākie raksti

Kādas ir Šlesera biznesa intereses Rīgā

Kādas ir mēra kandidāta Aināra Šlesera biznesa intereses Rīgā? Viņa ģimenei galvaspilsētā pieder prāvas platības Andrejsalā un Skanstē, bet ostas biznesi kara sankciju dēļ ir iestrēguši

Kurš kavē Rail Baltica pamattrases būvniecību

Kāpēc Rail Baltica nacionālais ieviesējs joprojām nav devis zaļo gaismu būvdarbu sākšanai dzelzceļa pamattrasē, lai gan finansējums ir pieejams

Mērs Vilnis Ķirsis: koalīcijai ir tikai divi varianti

Jaunās Vienotības saraksta līderi Vilni Ķirsi intervējam viņa kabinetā Rīgas domē. Domes priekšsēdētājs uzskata, ka vēlēšanās ir tikai divi varianti — vai nu JV, NA un Progresīvo vairākums, vai varu iegūs promaskaviskie spēki ar Šleseru priekšgalā

Kā pasaules apceļotājs Kārlis Bardelis nepadodas ļoti smagai diagnozei

Pasaules apceļotājs Kārlis Bardelis (40) gada sākumā piedzīvoja insultu un viņam atklāja ļaundabīgu smadzeņu audzēju. Ārstu prognozes nav spīdošas, bet Kārlis un ģimene nav gatavi padoties

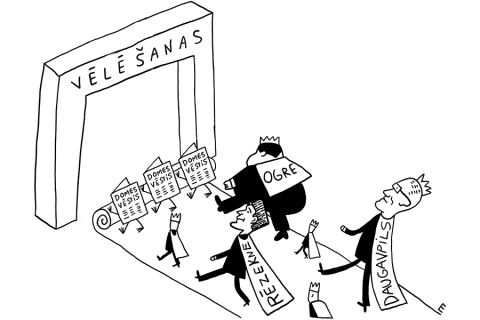

Kurš vadīs Rīgu?

Visticamāk, kāds no šiem partiju līderiem. Jaunākie reitingi cerības pārvarēt 5% barjeru dod septiņiem sarakstiem, vēl trīs pēdējie spējuši savākt vismaz 2% balsu. Ir piedāvā īsu pārskatu par viņu galvenajiem solījumiem

Šlesers nebūs mērs, bet kādas ir Kleinberga izredzes?

Aināra Šlesera plāns pārņemt Rīgu ir izgāzies. Balsu vairākums domē ir četru eiropeisko partiju koalīcijai, ko sācis veidot Progresīvo līderis Viesturs Kleinbergs. Vai viņš būs nākamais mērs?

Progresīvo kandidāts Kleinbergs: kā Rīga tika izlaupīta

Progresīvo kandidāts Rīgas mēra amatam Viesturs Kleinbergs uz interviju redakcijā ieradās demokrātiski — ar velosipēdu — un cer, ka valstiski domājoši vēlētāji Rīgā nepieļaus Šlesera atgriešanos pie varas

- Dzīve

- 29.05.2025.

- Agnese Meiere

Kā pasaules apceļotājs Kārlis Bardelis nepadodas ļoti smagai diagnozei

- Analīze

- 05.06.2025.

Kurš vadīs Rīgu?