Žurnāls Ir | Svarīgākais politikā, ekonomikā un kultūrā

Jaunākie raksti

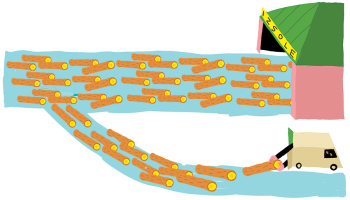

Klimata ministrija bīda foreles Rīgas līcī

Klimata ministrijas iejaukšanās dod iespēju Riga Bay Aquaculture apšaubīt vides ekspertu kritiskos atzinumus par foreļu fermu Rīgas līci

Darbs, ne maģija. Latvijas biatlona jaunā zvaigzne Estere Volfa

Šosezon Latvijas biatlonā spoži uzmirdzējusi jaunā zvaigzne Estere Volfa (20). Viņas panākumi junioru konkurencē un augstā vieta olimpiskajās spēlēs nav veiksme, bet gan cītīga darba rezultāts

32 valstis laidīs tirgū naftu no rezervēm

Pērn pieauga noziedzība

Ratiņkērlingisti izcīna bronzu

Lasīt vairāk →Īsi par svarīgāko ik rītu — pieraksties jaunumu vēstulei Ir Svarīgākais!

Labklājība bez izaugsmes. Intervija ar vides ekonomistu Timu Džeksonu

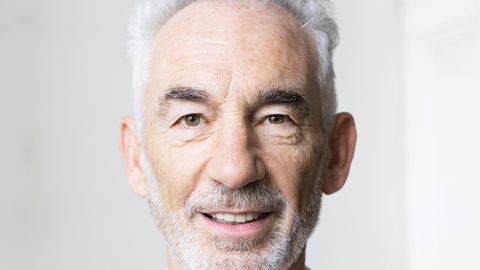

Pasaulē pazīstamais vides ekonomists Tims Džeksons (68) uzskata, ka dzīšanās pēc peļņas tuvina pasauli katastrofai

«Lai kur Streičs atrastos, cilvēki pie viņa tiecās.» Piemiņas vārdi izcilajam kinorežisoram

Kinorežisors Jānis Streičs (1936—2026) uzņēmis 22 filmas un atstājis paliekošas pēdas daudzu latviešu dvēselē. Gan caur filmu varoņiem, gan savā dzīvē izdzīvojot kāpumus un kritumus, viņš bija pārliecināts: «Brīnumi notiek. Bet tie ir jānopelna, un daudz jāstrādā»

Gaisa balonu pilote Inga van Havere sagādā Latvijai rekordu

Gaisa balonu pilote Inga van Havere ar dēlu Gabrielu Grīnbergu sasniegusi pirmos oficiālos Latvijas gaisa balonu rekordus

Raidieraksti

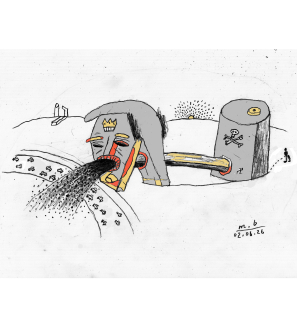

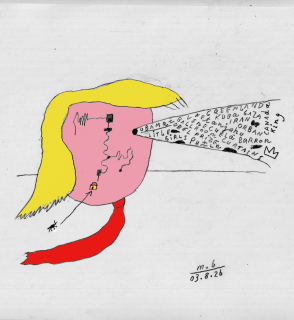

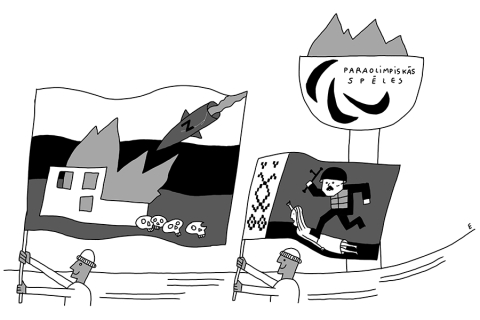

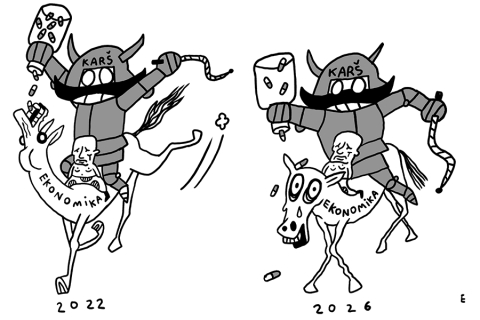

Karikatūra

Personības

Viedokļi

Satura mārketings

Carillon Aparthotel – jauns komforta un pilsētas ritma satikšanās punkts Vecrīgā

Vecrīgā durvis ir vērusi Carillon Aparthotel – jauna apartamentu viesnīca, kas piedāvā pārdomātu un ērtu uzturēšanos pašā Rīgas vēsturiskajā centrā. Tās atrašanās vieta netālu no Rīgas Doma baznīcas ļauj viesiem būt notikumu epicentrā, vienlaikus saglabājot mierīgu un privātu vidi, kur atpūsties pēc pilsētas iepazīšanas.Carillon Aparthotel piedāvā 6

ABB eksperts: savlaicīga apkope ir kritiska, lai novērstu dārgas elektroiekārtu dīkstāves

Igaunijas Harju apriņķī izvietotais ABB elektromotoru un ģenerātoru servisa centrs ir lielākais Baltijā un viens no visaugstāk novērtētajiem apkopes pakalpojumu sniedzējiem Ziemeļeiropā. ABB elektriskās piedziņas biznesa vadītājs Latvijā Jānis Senkāns skaidro, ar kādiem defektiem servisa speciālisti saskaras visbiežāk un kāpēc uzņēmumos ir svarīgi veikt savlaicīgu tehnikas apkopi.

Biežākās problēmas ar lietotām Audi automašīnām un pieprasītākās rezerves daļas Latvijā

Audi Latvijā jau gadiem ir viens no populārākajiem premium zīmoliem lietoto auto segmentā. A4 un A6 modeļi, kā arī Q sērijas krosoveri piedāvā labu aprīkojumu, komfortu un stabilu vadāmību par konkurētspējīgu cenu. Tomēr līdz ar moderniem TFSI un TDI dzinējiem, turbokompresoriem, tiešās iesmidzināšanas sistēmām un automātiskajām pārnesumkārbām pieaug arī uzturēšanas prasības. Ar nobraukumu noteikti mezgli sāk prasīt papildu uzmanību, un tieši šīs vietas visbiežāk nosaka kopējās ekspluatācijas izmaksas.Kāpēc Audi uzturēšana ar gad

Bizness un ekonomika

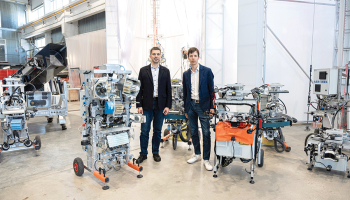

Bizness teltī

Telšu nomas uzņēmumu Tent Baltic savulaik izveidoja divi kolēģi ar lielu pieredzi pasākumu rīkošanā. Gadu gaitā paplašinot darbību, tas sācis būvēt teltis arī armijas un celtnieku vajadzībām

Vintāžas apģērbu zīmola Northern Grip veiksme

Beāte un Raitis Korti-Vītoli pirms vairāk nekā 15 gadiem sāka tirgot vintāžas apģērbu internetā. Nu zīmols Northern Grip izaudzis līdz četriem veikaliem Rīgā un Tallinā, un starp viņu klientiem ir pasaules slavenības

Patīkamas rūpes par sevi

No ikdienišķas draudzeņu sarunas līdz vienam no nozares vadošajiem uzņēmumiem — Taka spa 20 gadu jubileju sagaidījis ar miljona eiro apgrozījumu

Pētījumi

Eiropā

Recenzijas

Latgales Indrāni

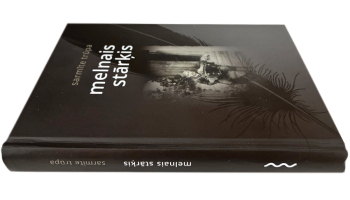

Garstāsts Melnais stārķis nominēts latgaliešu kultūras balvai Boņuks 2025

Laimes lācis Sūnu ciemā

Elmāra Seņkova iestudētā Bolderāja Mihaila Čehova Rīgas Krievu teātrī ir visai apzināta provocēšana. Cits jautājums — kuru sabiedrības daļu tā skar?

Ir Nauda

Domuzīme

Populārākie raksti

Dzīvās lelles. Kā modeles no Rīgas tirgoja miljonāriem

Bijušās modeļu aģentūras Vacatio modeles atklāj, kā ar aģentūras starpniecību saņēmušas miljonāru piedāvājumus

Pārdzimis Mārtiņš Freimanis? Saruna ar jauno aktieri Valtu Skuju

Šonedēļ Liepājas teātris skatītāju vērtējumam nodod izrādi par mūziķi Mārtiņu Freimani. Galveno varoni atveido jaunais aktieris Valts Skuja, kuram šī ir pirmā lielā loma

Nebaidās iet savu ceļu. Saruna ar muzikālo aktieri Eduardu Rediko

Muzikālais aktieris un dziedātājs Eduards Rediko (22) nebaidās iet savu ceļu. Viņš studē divās Latvijas Mūzikas akadēmijas programmās vienlaikus un nominēts Lielajai mūzikas balvai kategorijā Gada jaunais mākslinieks

Olimpisko spēļu atklāšanas ceremoniju vērtē latviešu režisori

Elmārs Seņkovs, Mārtiņš Eihe un Jānis Znotiņš pārspriež olimpisko spēļu atklāšanas ceremoniju

Ko var atrast Kara muzeja jaunajā datubāzē?

Ko var atrast Latvijas Kara muzeja izveidotajā datubāzē par karavīriem divos pasaules karos

Pusaudžu paškaitējums desmitkāršojies. Kā to apturēt?

Nemācēdami tikt galā ar emocionāliem pārdzīvojumiem, pusaudži sāk sev kaitēt — graiza ķermeni, indējas ar zālēm, dedzina, sit. Pēdējos septiņos gados paškaitējuma apjoms Latvijā desmitkāršojies. Kā apturēt šo bīstamo tendenci?

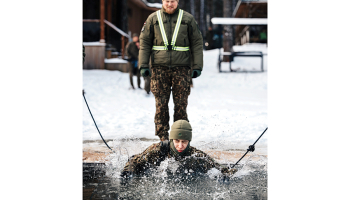

Kā divu miljardu tēriņi stiprinās Latvijas aizsardzību?

Budžetā šogad aizsardzībai atvēlēta rekordliela summa — 2,1 miljards eiro. Kādās militārās spējās plānots ieguldīt, un kā tās stiprinās mūsu drošību?

![Ledus [ice]. Māris Bišofs](https://media.ir.lv/media/cache/caricature_index__2xl__jpeg/uploads/media/image/2026021512144569919c9568804.png.jpeg)