Žurnāls Ir | Svarīgākais politikā, ekonomikā un kultūrā

Jaunākie raksti

«Tiesa nav likumdevēja.» Intervija ar ES Tiesas priekšsēdētāju Kūnu Lēnartu

Eiropas Savienības Tiesas priekšsēdētājs Kūns Lēnarts skaidro, ko īsti nozīmē lēmums par viendzimuma laulību atzīšanu un kad gaidāmi spriedumi par sankcijām pakļautajiem krievu oligarhiem

Vintāžas apģērbu zīmola Northern Grip veiksme

Beāte un Raitis Korti-Vītoli pirms vairāk nekā 15 gadiem sāka tirgot vintāžas apģērbu internetā. Nu zīmols Northern Grip izaudzis līdz četriem veikaliem Rīgā un Tallinā, un starp viņu klientiem ir pasaules slavenības

Dārgākā nafta kopš 2022. gada

JV rosina pārraut ekonomikas saites ar Krieviju

Dienesta pārbaudes par Rail Baltica

Lasīt vairāk →Īsi par svarīgāko ik rītu — pieraksties jaunumu vēstulei Ir Svarīgākais!

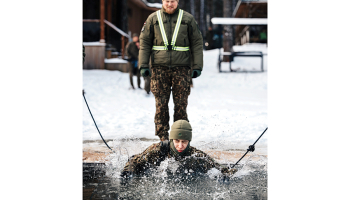

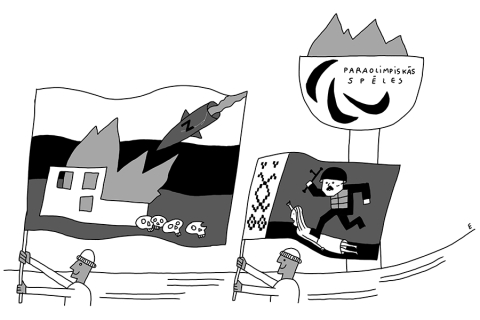

Iespējams ir viss! Paralimpietes Elija Asniņa un Linda Meijere

Ziemas paraolimpiskajās spēlēs Milānā—Kortīnā Latviju līdz ar citiem sportistiem pārstāvēs ratiņkērlingistes Elija Asniņa (16) un Linda Meijere (26). Abas ir pārvarējušas daudz sāpju un grūtību un izlēmušas — iespējams ir viss

Ar Bunkus slepkavības lietā notiesāto Babenko saistīts uzņēmums grib turpināt tirgoties cietumos

Ar maksātnespējas administratora Mārtiņa Bunkus slepkavības lietā notiesāto Aleksandru Babenko saistīts uzņēmums cīnās par tiesībām tirgoties cietumu veikalos

Raidieraksti

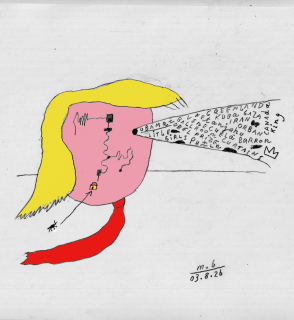

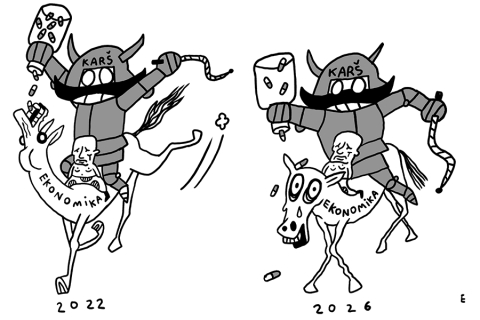

Karikatūra

Personības

Viedokļi

Satura mārketings

Carillon Aparthotel – jauns komforta un pilsētas ritma satikšanās punkts Vecrīgā

Vecrīgā durvis ir vērusi Carillon Aparthotel – jauna apartamentu viesnīca, kas piedāvā pārdomātu un ērtu uzturēšanos pašā Rīgas vēsturiskajā centrā. Tās atrašanās vieta netālu no Rīgas Doma baznīcas ļauj viesiem būt notikumu epicentrā, vienlaikus saglabājot mierīgu un privātu vidi, kur atpūsties pēc pilsētas iepazīšanas.Carillon Aparthotel piedāvā 6

ABB eksperts: savlaicīga apkope ir kritiska, lai novērstu dārgas elektroiekārtu dīkstāves

Igaunijas Harju apriņķī izvietotais ABB elektromotoru un ģenerātoru servisa centrs ir lielākais Baltijā un viens no visaugstāk novērtētajiem apkopes pakalpojumu sniedzējiem Ziemeļeiropā. ABB elektriskās piedziņas biznesa vadītājs Latvijā Jānis Senkāns skaidro, ar kādiem defektiem servisa speciālisti saskaras visbiežāk un kāpēc uzņēmumos ir svarīgi veikt savlaicīgu tehnikas apkopi.

Biežākās problēmas ar lietotām Audi automašīnām un pieprasītākās rezerves daļas Latvijā

Audi Latvijā jau gadiem ir viens no populārākajiem premium zīmoliem lietoto auto segmentā. A4 un A6 modeļi, kā arī Q sērijas krosoveri piedāvā labu aprīkojumu, komfortu un stabilu vadāmību par konkurētspējīgu cenu. Tomēr līdz ar moderniem TFSI un TDI dzinējiem, turbokompresoriem, tiešās iesmidzināšanas sistēmām un automātiskajām pārnesumkārbām pieaug arī uzturēšanas prasības. Ar nobraukumu noteikti mezgli sāk prasīt papildu uzmanību, un tieši šīs vietas visbiežāk nosaka kopējās ekspluatācijas izmaksas.Kāpēc Audi uzturēšana ar gad

Bizness un ekonomika

Patīkamas rūpes par sevi

No ikdienišķas draudzeņu sarunas līdz vienam no nozares vadošajiem uzņēmumiem — Taka spa 20 gadu jubileju sagaidījis ar miljona eiro apgrozījumu

Kustība + zinātne = veselība

«Šo gadu laikā bija tikai viens kungs, kurš lūdza tabletīti, kas palīdzētu kļūt trenētākam. Pārējie saprot, ka būs jādara pašiem,» saka Sandra Rozenštoka, kura ikdienā gan sportistiem, gan «parastajiem» cilvēkiem palīdz būt veselākiem

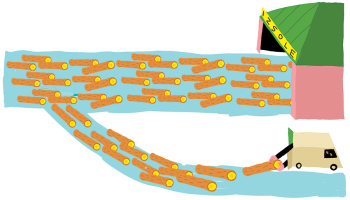

Ābolu gūstītāji – Zilver veiksmes stāsts

Jānis Zilvers ar augļkopību Siguldas pusē sāka nodarboties jau pirms neatkarības, bet dēls Reinis, izstudējis filozofiju, atgriezās ģimenes saimniecībā, lai pievērstos eksotisku vīnu darīšanas mākslai. Biznesā jāsadarbojas ar konkurentiem, viņi apgalvo

Pētījumi

Eiropā

Recenzijas

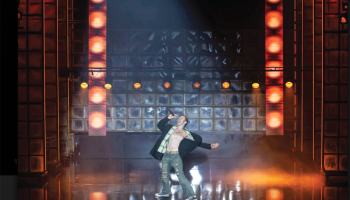

Smalkjūtīgs kases grāvējs

Liepājas teātra izrādes Freimanis biļetes jau izpārdotas līdz sezonas beigām

Paralēlas pilsētas, paralēli stāsti

Jaunajā romānā Murakami atgriežas pie sena stāsta, parādot tā noslēpumaino pilsētu no jauna skatpunkta

Ir Nauda

Domuzīme

Populārākie raksti

Dzīvās lelles. Kā modeles no Rīgas tirgoja miljonāriem

Bijušās modeļu aģentūras Vacatio modeles atklāj, kā ar aģentūras starpniecību saņēmušas miljonāru piedāvājumus

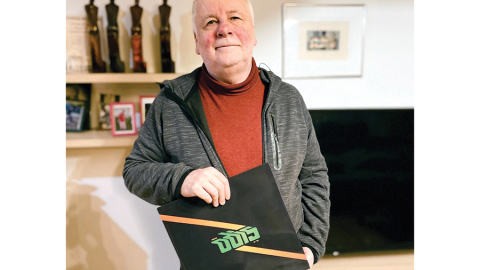

Pārdzimis Mārtiņš Freimanis? Saruna ar jauno aktieri Valtu Skuju

Šonedēļ Liepājas teātris skatītāju vērtējumam nodod izrādi par mūziķi Mārtiņu Freimani. Galveno varoni atveido jaunais aktieris Valts Skuja, kuram šī ir pirmā lielā loma

Kā Latvija iepinās skandalozajā filmā «Kremļa burvis»

Šonedēļ Latvijas kinoteātru repertuārā nonāk Rīgā filmētais Kremļa burvis. Šis ļoti dārgais projekts saskārās ar neparedzētiem finansiāliem šķēršļiem un kritiku par to, ka krievu tēli filmā attēloti pārāk pozitīvi

Epstīns un Rīgas «satriecošās meitenes»

Meitenes, paciņas un nauda uz Pļavniekiem. Ko par Rīgu var uzzināt Epstīna failos?

Nav neuzvaramu situāciju! Dziedātāja Atvara

Eirovīzijas dziesmu konkursa kvēlākie fani ārvalstīs par lielajai skatuvei vispiemērotāko dziesmu no Latvijas šogad uzskata Atvaras balādi Ēnā. Viņai gan šajā nedēļas nogalē vēl jāpārvar nacionālās atlases pusfināls

Olimpisko spēļu atklāšanas ceremoniju vērtē latviešu režisori

Elmārs Seņkovs, Mārtiņš Eihe un Jānis Znotiņš pārspriež olimpisko spēļu atklāšanas ceremoniju

![Ledus [ice]. Māris Bišofs](https://media.ir.lv/media/cache/caricature_index__2xl__jpeg/uploads/media/image/2026021512144569919c9568804.png.jpeg)