Žurnāls Ir | Svarīgākais politikā, ekonomikā un kultūrā

Jaunākie raksti

Kā Rīgas mērs Viesturs Kleinbergs apdedzinājās, tomēr atgriezās politikā

Jaunais Rīgas mērs Viesturs Kleinbergs (47) pirms vēlēšanām nebija plaši pazīstams, bet tuvākie kolēģi viņu vērtē kā enerģisku «pārmaiņu vadītāju» un cilvēku, kas nepiever acis uz nodokļu naudas izšķērdēšanu

Kāpēc Vidzemes tirgus investoru Ukrainā dēvē par kontrabandas karali

Armēnijas miljonārs Artūrs Grancs grasās atjaunot Vidzemes tirgu, visā kvartālā tuvāko gadu laikā ieguldot 56 miljonus eiro. Tikmēr ukraiņu nevalstiskā organizācija Non-stop dēvē viņu par «kontrabandas karali»

Sāc savu dienu ar uzticamu svarīgāko ziņu apkopojumu!

Īsi par svarīgāko ik rītu — pieraksties jaunumu vēstulei Ir Svarīgākais!

Kā mūzika apvienoja trīs latviešus un trīs ebrejus

«Jau otrajā dziesmā dzied un aplaudē visi» — tā par latviešu un ebreju saprecinātajām melodijām saka grupas Black Rooster Kapelye dalībniece Ilga Vālodze. Grupa, kurā apvienojušies trīs latvieši un trīs ebreji, šonedēļ spēlēs Valmiermuižas etnomūzikas festivālā

Ko paveikuši birokrātijas sloga mazinātāji

Valsts birokrātijas mazinātāji solīja pirmos rezultātus ap Jāņiem. Kas ir izdevies?

Šitake sēņu audzētava barona Firksa bijušajā muižā

Kamēr strādāja algotu darbu, Andris Vjaksa atvaļinājumu vienmēr ņēma sēņu laikā. Tagad viņš sēnes audzē pats. Šitake sēnes

Raidieraksti

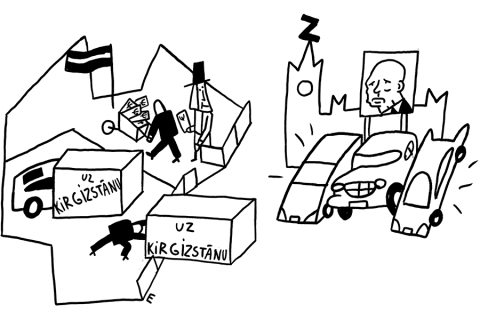

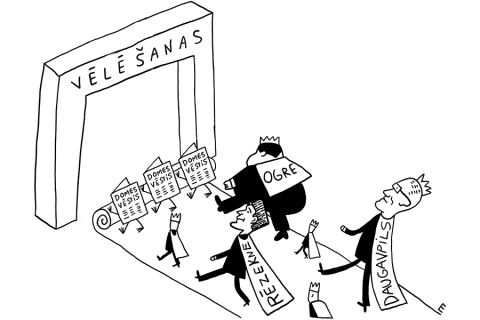

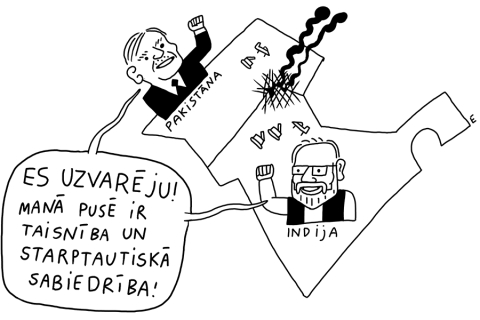

Karikatūra

Personības

Viedokļi

Recenzijas

Barselonas sesijas

Prāta vētras jaunais albums sākas emocionāli daudzslāņaini un muzikāli pašpietiekami, bet tad sāk zaudēt fokusu

Pētījumi

Eiropā

Bizness un ekonomika

Miljoni vafeļu

Pirms daudziem gadiem mamma Viktoram Ratkevičam solījusi: «Mūsu ģimene reiz būvēs rūpnīcas!» Tagad viņš ir vafeļu ražošanas uzņēmuma Vafelīte valdes priekšsēdētājs, un izaugsme esot tik strauja kā vēl nekad

Saulkrastu superpīrāgi

Saulkrastu uzņēmuma Superpīrāgs īpašniece Ilze Kalviša savu biznesu savulaik sāka, bruņojusies ar pavārgrāmatu un paļāvību, bez mazākās pieredzes konditorejā un visu nepieciešamo aizņemoties

Pāļu injekcijas pamatiem

Mikropāļi ir samērā jauna būvniecības tehnoloģija, kuru Latvijā un Igaunijā jau 25 gadus attīsta Daiņa Mūsiņa uzņēmums. Savulaik četri gadi nostrādāti arī Apvienotajos Arābu Emirātos, bet tagad tuvākais mērķis ir iespiesties Lietuvas tirgū

Populārākie raksti

Kādas ir Šlesera biznesa intereses Rīgā

Kādas ir mēra kandidāta Aināra Šlesera biznesa intereses Rīgā? Viņa ģimenei galvaspilsētā pieder prāvas platības Andrejsalā un Skanstē, bet ostas biznesi kara sankciju dēļ ir iestrēguši

Kāpēc Vidzemes tirgus investoru Ukrainā dēvē par kontrabandas karali

Armēnijas miljonārs Artūrs Grancs grasās atjaunot Vidzemes tirgu, visā kvartālā tuvāko gadu laikā ieguldot 56 miljonus eiro. Tikmēr ukraiņu nevalstiskā organizācija Non-stop dēvē viņu par «kontrabandas karali»

Kurš vadīs Rīgu?

Visticamāk, kāds no šiem partiju līderiem. Jaunākie reitingi cerības pārvarēt 5% barjeru dod septiņiem sarakstiem, vēl trīs pēdējie spējuši savākt vismaz 2% balsu. Ir piedāvā īsu pārskatu par viņu galvenajiem solījumiem

- Analīze

- 03.07.2025.

- Ieva Jakone

Kāpēc Vidzemes tirgus investoru Ukrainā dēvē par kontrabandas karali

- Analīze

- 05.06.2025.

Kurš vadīs Rīgu?

Prokurore: Stukānam vajadzēja vēl vienu apsūdzēto

Ģenerālprokurors Juris Stukāns rīkojies neētiski, bet tas nav pamats viņa atlaišanai, pārbaudē secinājuši Augstākās tiesas senatori. Prokurores Viorikas Jirgenas stāstītais gan atklāj uztraucošu ainu Ģenerālprokuratūrā

Šlesers nebūs mērs, bet kādas ir Kleinberga izredzes?

Aināra Šlesera plāns pārņemt Rīgu ir izgāzies. Balsu vairākums domē ir četru eiropeisko partiju koalīcijai, ko sācis veidot Progresīvo līderis Viesturs Kleinbergs. Vai viņš būs nākamais mērs?

Oligarhu atlaidējs Valdis Zatlers par bailīgajiem politiķiem un mūsu drošību

Eksprezidents Valdis Zatlers aicina uzņemties atbildību un doties balsot, lai gan atzīst — pats vēl gaida kādu pēdējā brīža skandālu, kas palīdzēs izdarīt izvēli

Folkloristes Ilgas Reiznieces padomi skaistai līgošanai

Pirms 20 gadiem mūziķe un folkloriste Ilga Reizniece (69) sāka nebijušu akciju visā Latvijā — astoņus gadus ik jūniju mācīja skaisti līgot un piedzīvot Jāņus ar rituāliem. Kādus viņa šodien redz mūs — savus izskolotos jāņabērnus?