Ilustratīvs attēls no pixabay.com

Corona hit us, creating a recession due to lockdown of several parts of our economies. The government of Latvia has done quite a lot to ameliorate this situation and the EU is underway with “The largest stimulus package ever” (their words, not mine) – 750 billion EUR (that is about 25 years of current annual Latvian GDP, so, yes, it is big) in assistance called NextGenerationEU of which 672.5 bill. EUR is the so-called RRF, Recovery and Resilience Fund. Idea: To repair our economies following the losses due to corona. Here is a link to the Latvian Ministry of Finance, providing information about RRF in Latvia.

Latvia stands to obtain, at first, 1.65 bill. EUR, some 5.5% of GDP – but does the economy really need this much money to recover?

I will try to argue that perhaps it does not (which is NOT the same as saying no, thank you to the money….) and that it may instead lead to overheating – and, let’s face it with so much money, also waste and inefficiency here and there.

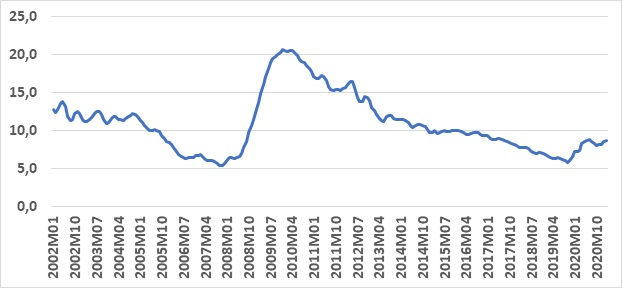

Prior to corona the Latvian economy was doing well. Unemployment in the beginning of 2020 was just over 7%, see Figure 1; lower levels were observed only in 2019 as well as in parts of 2006 – 2008 so, if anything, the Latvian economy was already overheating a bit or at least on the verge of this.

Figure 1: Unemployment rate (15 – 74 year of age), Latvia, 2002-I – 2021-II

Source: Central Statistical Bureau

Then corona struck.

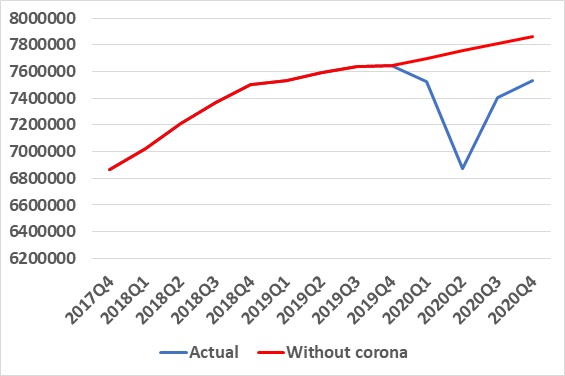

In Figure 2 (and now it gets very back-of-the-envelope in terms of calculations but this should be allowed for a blog post) I show how the economy performed through 2020. This is in nominal terms but since inflation has been very close to zero the distinction between nominal and real has been almost absent. GDP dropped in Q1 of 2020 and especially in the 2nd quarter but then started a rebound. With the red curve (back-of-the-envelope, back-of-the-envelope) I make a simple projection of how the economy would have developed if it had continued to grow as in the previous years with an annual growth rate of about 2.9% per year (it was actually forecast to grow a bit more slowly) and then I get two trajectories: Actual performance (in blue) and a possible scenario (in red), had corona not happened.

Figure 2: Development of Latvian GDP by quarter in nominal terms (1000 EUR). In blue as it turned out, in red if corona had not happened and the economy had developed as in the previous two years.

Source: Central Statistical Bureau and own calculations

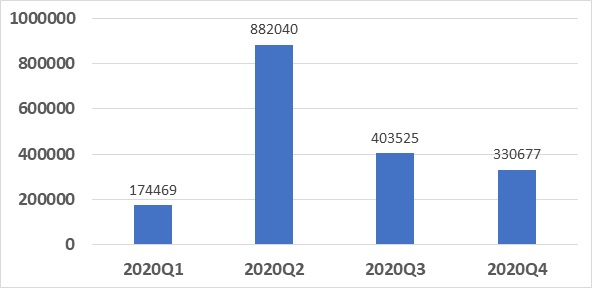

I can manipulate a bit more with this, see Figure 3. The loss of GDP in e.g. the 2nd quarter of 2020 was 882 mill. EUR – a huge amount – compared to my scenario of what it would have looked like, had corona not happened.

Figure 3: GDP “lost” to corona. Difference between blue and red lines in Figure 2, 1000 EUR, quarterly, 2020 Q1 – 2020 Q4

Source: Central Statistical Bureau and own calculations

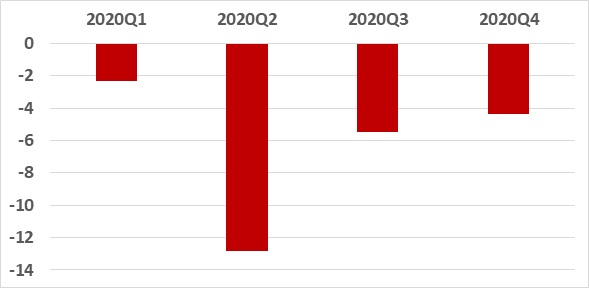

And one more way to illustrate this, Figure 4 – the percentage deviation between the actual outcome and my simple scenario.

Figure 4: GDP “lost” to corona. Percentage difference between blue and red lines in Figure 2, quarterly, 2020 Q1 – 2020 Q4

Source: Central Statistical Bureau and own calculations

In the 2nd quarter of 2020 the economy was a jaw-dropping 12.8% below the non-corona scenario but this deviation had dropped to just 4.4% by the 4th quarter of 2020.

And with vaccinations being completed (OK, a lot to ask for…) this already very diminished gap is set to close and the economy is (more or less) back on track. One can easily imagine a “ketchup effect” when lockdown restrictions are removed and travel will be possible, just like restaurant visits etc. Some built-up savings will be released into the economy, creating a fairly sharp increase in GDP and blue will catch up with red.

Yes, altogether GDP will have been lost but it will have been lost forever – we will not have haircuts done twice as often and we will not go to a restaurant twice in one evening in post-corona times.

To me, this NextGenerationEU spending comes too late to Latvia, trying to fix an economy that will not be all that broken.

Thus, too late and too much is my prediction.

PS: For simplicity, I have omitted any discussion of corona having changed potential GDP for the economy (it may have decreased due to some industries, e.g. travel, being perhaps permanently hurt. I also have omitted any discussion of the RRF raising this potential, which would be very welcome. And I have not addressed the “oomph” to the economy of the 1.65 bill. EUR spending (we call it the multiplier effect). It could also be noted that there is a somewhat similar debate in the USA about the impact of President Biden’s 1.9 trillion USD package.

Morten Hansen is Head of Economics Department at Stockholm School of Economics in Riga and Vice-Chairman of the Fiscal Discipline Council of Latvia