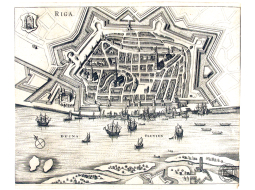

Ilustratīvs attēls

That may at first sound a bit strange but if inflation is to come down then a recession would certainly help – lower economic activity implies lower demand for energy which implies lower energy prices, which will lower inflation.

And with inflation running much higher than wage growth, i.e. with real wages dropping, leaving most with quite a bit lower purchasing power, I am quite sure we are in for a recession in 2023. A small and short one, possibly just in end-2022 – beginning of 2023 but I think it is coming.

Forecasts from Bank of Latvia (BoL), the Latvian Ministry of Finance (MoF), the International Monetary Fund (IMF) and the European Commission (EC) are not (yet?) so gloomy but that may be due to the time the forecasts were made, see Figure 1 – 2022 is a year where economic data has changed dramatically during the year, both in terms of growth and inflation. The year started with significant growth due to what we could call a post-pandemic surge. Then Russia invaded Ukraine and sanctions reduce exports to Russia while dramatically increasing energy prices eat away at our incomes with both effects leading to a drop in demand – and thus growth – in the economy. Add to this higher interest rates from the ECB and you have yet another effect that will dampen economic activity.