Ilustratīvs attēls no Pixabay.com

The proposal is known by most, I assume, otherwise here is a description.

In what follows, I am not arguing in order to support the banks – rather, to support Latvia’s economic development, which I think will be jeopardized by this ill-thought proposal.

Proposals to help consumers can certainly have merit. This, they will have when a) circumstances are very unusual and b) when they refer to vulnerable groups. A good example of when this was relevant was last year’s very high energy prices. A one-off (we hope) phenomenon which was threatening especially low-income groups.

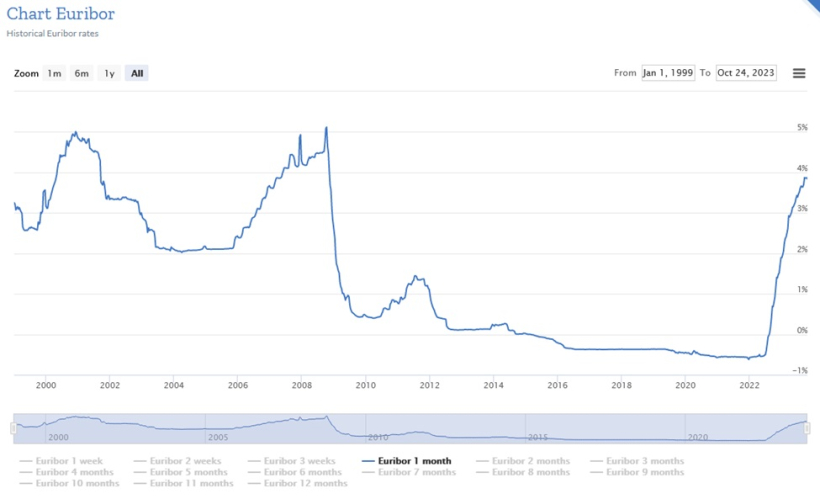

Neither is fulfilled in this case. Mortgage rates in Latvia are typically based on a Euribor interest rate (a rate at which banks can borrow from each other) plus a certain percentage, here often 1.6 percentage points. Euribor rates have certainly gone up (see Figure 1) but they are far from unusually high – rather they were unusually low for a long period. Why support households for having to pay normal interest rates?

Bear also in mind that the vast majority mortgage owners are better-off people (Swedbank data says average household income of 3500 EUR per month). Why support households with high incomes? This is a ridiculously regressive measure.

Figure 1: Historical Euribor interest rates (here Euribor 1 month), 1999 – present.

Source: Euribor-rates.eu

Note: Other Euribor rates are closely correlated with the one shown

And then just a few economic arguments for why this is bad for long-term economic development of Latvia.

This proposal will be seen negatively by potential foreign investors who, rightly, will think that law-making in Latvia is capricious and unpredictable. I thought that Latvia tried to promote itself as an attractive destination for foreign investment? This will make investors go to Estonia, Lithuania or elsewhere instead.

This proposal will be seen negatively by the ratings agencies since the proposal interferes in the free market’s setting of prices, here interest rates. Does Latvia really want to risk a potential ratings cut with potentially higher borrowing costs for the government?

This proposal will certainly be seen negatively by banks that might otherwise consider entering the Latvian market. The proposal will thus limit competition in the banking sector, not increase it. That was obviously not the intention.

It has been mentioned (LETA news, 25 October 2023) that a proposal might be to let Altum, the state-owned finance institution, be transformed into a bank to create more competition. And take lending risks that the existing commercial banks won’t take? Ehhh… I cannot be the only person to remember Hipotēku un zemes banka, which provided soft loans back in the days of the “fat years” and of course went belly-up when the financial crisis hit. Does Latvia want to risk a repetition of this scenario?

I am all for more competition, also in the banking sector, but, please, no return to the days of e.g. Parex or Trasta Komercbanka either.

The proposal is poor economics through and through and represents a populist approach: Be harsh on the banks (not loved by anyone and mostly foreign-owned, so what is there to lose in terms of vote-collection?).

But it will do no good to long-term development of Latvia and that is the single issue that truly matters. Banking will be hurt, investment will be hurt, and Latvia’s reputation will be hurt.

For what?

Morten Hansen is Head of Economics Department at Stockholm School of Economics in Riga and former Vice-Chairman at the Fiscal Discipline Council of Latvia