Ilustratīvs attēls

In a previous column I asked:

- Is inflation on its way up?

- Will we witness a longer period of sustained higher inflation?

That column dealt with the first question and the answer was a definite yes. This column addresses the 2nd question.

My conclusion will be a) I hope not and b) I think not. Here are my arguments; as I often do, using Latvian data when relevant.

Right now, inflation is rising due to the pandemic subsiding and the economies reawakening. A good example of the difference between a short-term or transitory increase in inflation versus long-term sustained increase in inflation can come from a look at oil prices. Oil is an input in many industries and its price acts as a cost for firms. Higher oil prices, higher costs – and firms will try to pass on those costs to you and me with higher prices, causing higher inflation.

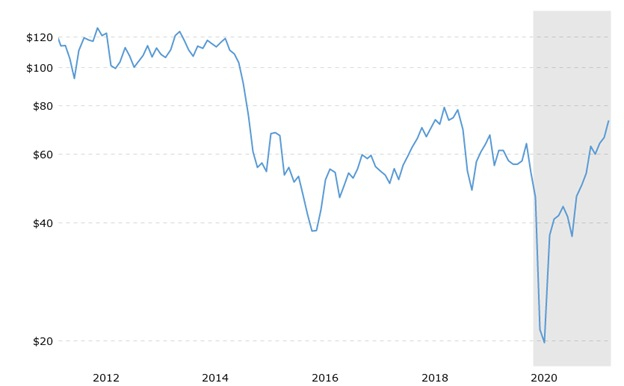

This is happening right now as can be seen from Figure 1. During lockdowns in the beginning of the pandemic planes did not fly, demand for oil plummeted and so did its price, causing deflationary pressure. Now, with the reopening of economies, demand for oil is up again and so is its price, causing inflationary pressure. Simple.

But if the difference between transitory inflation pressure and long-term, persistent inflation pressure is also obvious from the graph: Oil prices have basically just made a comeback to where they were in early 2020 – if they should cause sustained inflation pressure they would have keep rising and rising, and nothing suggests that will happen (with higher prices more oil production facilities become profitable and supply will increase, too, putting a lid on prices).

Figure 1: Oil prices (per barrel), past ten years

Source: https://www.macrotrends.net/1369/crude-oil-price-history-chart

Similar stories go for other commodity prices.

One place, often cited for its ability to create sustained higher inflation is the labour market. In a tight labour market, the story goes, employees will find it easier to ask for and obtain higher wages. But these higher wages act as costs for firms – they react by raising prices but higher prices reduce the purchasing power of our wages, making us ask for even higher wages as compensation and a feedback loop between prices and wages is created, the so-called wage-price spiral.

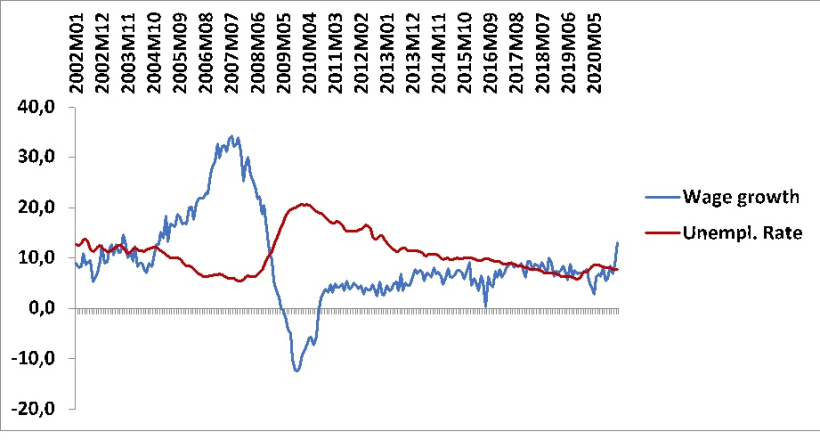

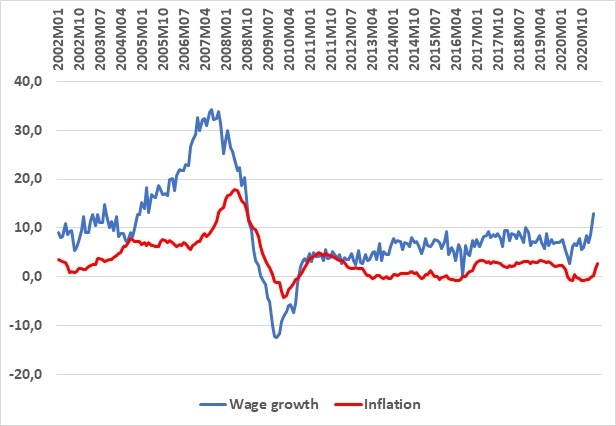

As an example, this story seemed to work quite well during the times of the credit bubble and the subsequent financial crisis in Latvia. As unemployment kept shrinking (see Figure 2), wage growth accelerated (perhaps “exploded” is a better word….) and as wages rose rapidly, so did inflation (Figure 3). When the financial crisis struck this went into reverse – at high unemployment no-one asked for higher wages, in fact wages plummeted and with them prices. It is still striking that in May 2008 inflation in Latvia was 17.9%, the EUs highest. Less than two years later, in February 2010, it was minus 4.2%, the EUs lowest rate. A drop of 22 percentage points in just as many months, unseen anywhere else in the Eurozone ever.

Figure 2: Wage growth (year-on-year) and the unemployment rate, monthly data, Latvia, 2002-I – 2021-III

Source: Official Statistical Portal, https://stat.gov.lv/en

Figure 3: Wage growth (year-on-year) and the inflation rate, monthly data, Latvia, 2002-I – 2021-V

Source: Official Statistical Portal, https://stat.gov.lv/en

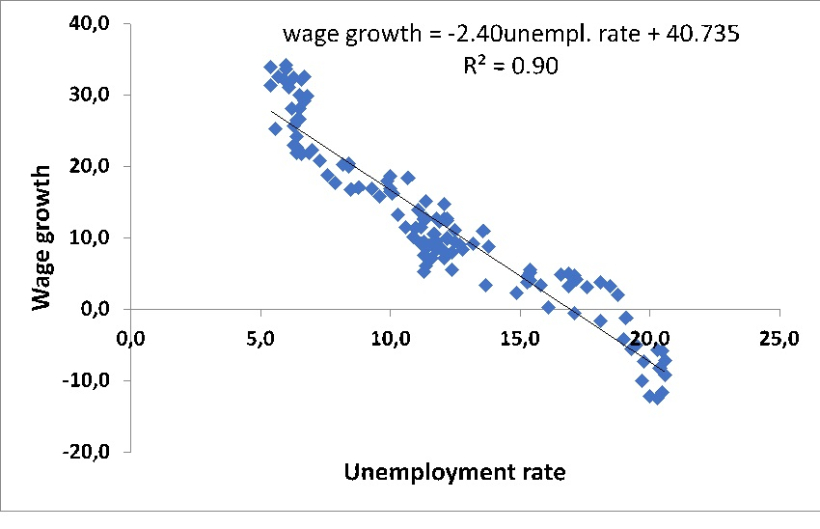

A better illustration, perhaps, comes with Figures 4 and 5 that try to be more explicit in portraying the relationship between a tight labour market, as measured by the unemployment rate and the rate of changes of wages.

Figure 4 looks at the period leading up to and including the financial crisis. There is an obvious (and statistically very strong)) relationship between wage growth and the unemployment rate (known as the Phillips curve to those who work with it). Allow me some anecdotal evidence – the bubble times were rather euphoric. A super-hot labour market where employees had a very strong bargaining position but also a time when, as inflation crept up and up, inflation overtook real estate prices as the economic issue of most concern in the daily debate. Everybody talked about rising prices and it was obvious that people incorporated expected rising inflation into their wage demands. The wage-price spiral worked its sinister magic very well and expected inflation thus helped create real inflation.

Figure 4: Wage growth (2nd axis) plotted against the unemployment rate, Latvia, 2002-I – 2011-XII

Source: Official Statistical Portal, https://stat.gov.lv/en and own calculations

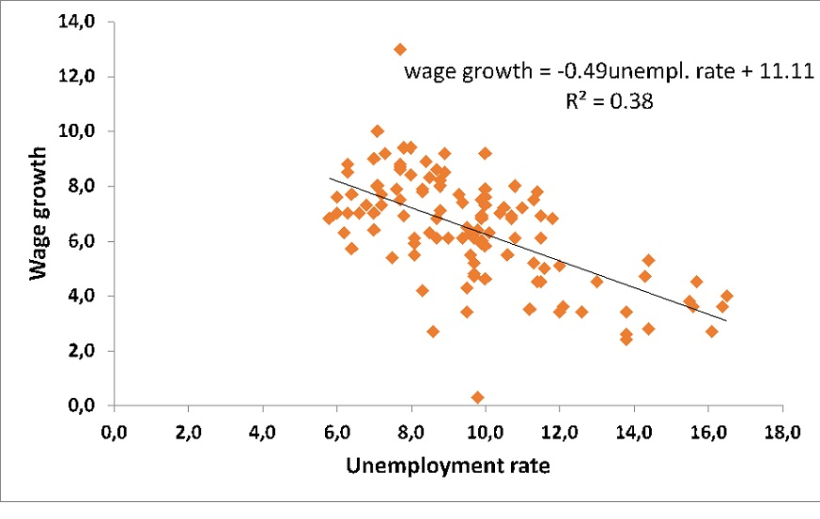

As can be seen from Figure 5, the relationship is still there but it is much weaker and, crucially, a lower unemployment rate is not associated with as strong wage increases as in Figure 4. The Phillips curve has become flatter, a phenomenon that seems to have happened in many countries. The wage-price spiral is no longer as strong as it used to be and low unemployment is less inflationary than it was (there are many theories about why – trade unions are less important than they used to be; bottlenecks in labour markets are more easily overcome by workers being more willing to migrate; outsourcing in industries with high labour costs etc.).

Figure 5: Wage growth (2nd axis) plotted against the unemployment rate, Latvia, 2012-I – 2021-III

Source: Official Statistical Portal, https://stat.gov.lv/en and own calculations

But another factor that is needed to create sustained, higher inflation would be an accommodating monetary policy, i.e. the ECB accepting such higher inflation.

If one believes in the ECB mantra of “close to but below 2% inflation in the medium term” (and I do) then the ECB will intervene with higher interest rates to cool labour markets and thus wage growth and inflation, if the latter should remain above 2% for some time.

In short, high, sustained inflation is only really possible if there is a relentless push from wage costs in the labour market, paired with a monetary policy that accepts these costs creating higher inflation. It is the unambiguous primary objective of the ECB (their words, not mine) to maintain price stability in the Eurozone. I don’t see that they will risk losing their credibility by not adhering to this objective.

Still, one should watch the following:

- Italian debt sustainability and low interest rates – may the ECB have become a hostage of its own low interest rate policy? Having to keep interest rates low to act as life support for Italy, even if higher inflation might dictate higher rates?

- Independent central banks that are less independent than they should be? Christine Lagarde, President of the ECB is a former finance minister of France. Mario Draghi, the former ECB president is now Prime Minister of Italy. An unhealthy mix?

Thus, I will stick to the point that the current rise in inflation is transitory – but I will be watching developments in Italy and the ECB.

Morten Hansen is Head of the Economics Department at the Stockholm School of Economics in Riga and Vice-Chairman of the Fiscal Discipline Council of Latvia.