Ilustratīvs attēls no pixabay.com

There is surprisingly much talk in Latvia of an imminent economic crisis.

Surprising, since it is not going to happen.

I will try to argue that almost all indicators in Latvia look favouarable right now and do not point to any crisis; I will even argue that a minor slowdown should be welcome.

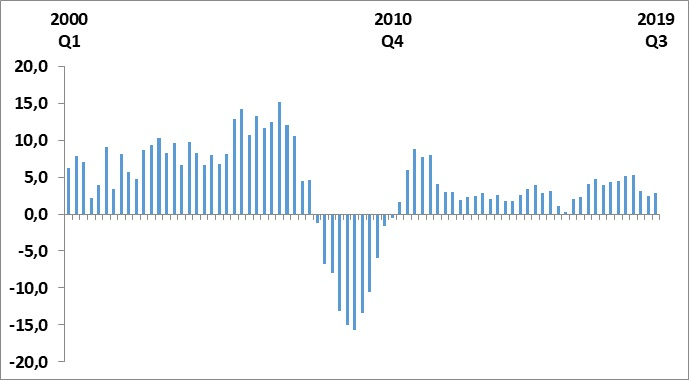

Some background: The economy has been expanding for nine years in a row (35 quarters to be precise), since emerging from the recession after 2010, see Figure 1.

Figure 1: Economic growth in Latvia, 2000 Q1 – 2019 Q3

Source: Central Statistical Bureau

Contrary to the boom preceding the financial crisis, this period of growth has not been the result of a credit boom (many slides; e.g. p. 4). No credit boom = no ensuing credit bust, i.e. no repeat of 2008 possible right now. And with no credit boom there hasn’t been a real estate boom and thus no collapse of the real estate market can happen either. Another indicator of stability here is the current account balance – massive deficits preceding the financial crisis reflected tremendous borrowing from abroad; right now the current account balance is, well, balanced.