Ilustratīvs attēls

A quick overview of the Russian, Ukrainian and other Eastern European economies with some graphs and a few conclusions.

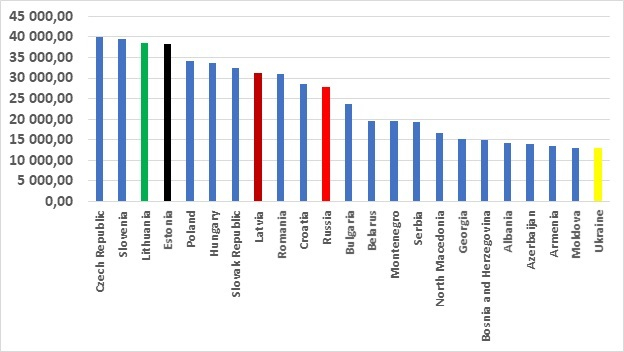

Russia may have overwhelming military forces. In some places inept and incompetent, but overwhelming. But it is not a wealthy country by European standards. Figure 1 lists all the Eastern European countries (bar Kosovo) in terms of income per person as measured by GDP per capita. Russia is ahead of only one EU country, namely Bulgaria and thus poorer than any of the other 26. Ukraine is today Europe’s poorest country, a place otherwise long held by Moldova. This is partly due to Russia – Donbass and the annexation of Crimea do not exactly spur investment into Ukraine but I don’t think I insult that many by stating that it is also the responsibility of Ukraine itself. Several of its previous leaders have been less than inspiring, in politics as well as in economics, to say the least, and corruption is endemic – Ukraine ranks 122nd of 180 countries on Transparency Internationals 2021 list. Russia is 136th while Latvia is at rank 36.

Do also note that the ten richest Eastern European countries are all members of the EU.

Figure 1: Eastern Europe: GDP per capita, 2021 in constant 2017 USD, adjusted for purchasing power

Source: IMF

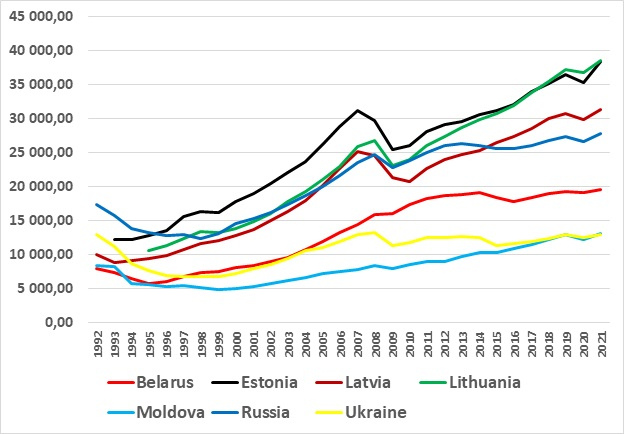

Ukraine’s economic development over time has been poor – sadly very poor, see Figure 2. The country is more or less at the level it had 30 years ago at the time of independence and its path of development is completely different from that of the Baltic countries where incomes, in constant prices, have more than tripled since independence.

Russia has also seen growth but, crucially, this has stalled for the past ten years and in 2015 Russia was overtaken by a Latvia that never looked back. Today, Latvia’s income per person is 12% higher than in Russia, a difference that will increase as the current war will create a recession in Russia; sanctions will ensure that.

Figure 2: GDP per capita, constant 2017 USD, 1992 – 2021, selected ex-USSR countries

Source: IMF

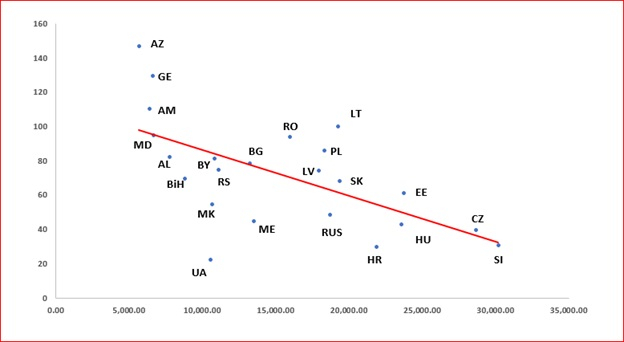

A look at the performance of the countries in an EU context is illustrated by Figure 3. On the 1st axis you find a country’s GDP per capita in 2004, the year of EU accession for eight of the Eastern European countries (including Latvia, of course) – and, as seen in Figure 1, exactly those eight that occupy the top spots. (Bulgaria and Romania joined in 2007; Croatia in 2013). On the 2nd axis we have the growth of GDP per capita since 2004.

Theory on economic convergence will state that a poorer country will typically grow faster than a richer country over time – by being poor, it has more growth potential. This is confirmed by this data and seen in the downward-sloping trend.

Being above the trend line indicates – roughly – a better-than-average growth performance than one should expect, given the country’s starting point in 2004 and below the line a worse-than-average experience, again, given the starting point.

Besides the three Caucasian republics that have grown a lot but also came from being seriously behind, we see that all the countries above the trend line are EU members with Lithuania being the shining star. Countries below the trend line are all outside the EU with the exceptions of Hungary and Croatia (the late joiner).

This is not deep research but it seems to provide strong evidence in favour of that joining the EU – with free trade, access to all markets, flows of capital, technology etc. – is good for your economy as economic theory would predict.

Russia has underperformed and the worst performance, sadly, is for Ukraine.

Again, this is not deep research; it is a blog post after all, but a hefty dose of EU accession and a separation from Russia seems to be the right medicine for Ukraine.

Figure 3: Eastern Europe, growth in constant prices of GDP per capita, 2004 – 2021 (2nd axis) against the starting point (2004 GDP per capita) on the 1st axis.

Source: IMF and own calculations

And the lesson for Mr. Putin should be to read more economics books and fewer history books.

Morten Hansen is Head of Economics Department at Stockholm School of Economics in Riga and Vice-Chairman of the Fiscal Discipline Council of Latvia.

Points of view expressed here at not necessarily those of the Fiscal Discipline Council of Latvia.