Ilustratīvs attēls

I am one of those old-fashioned (?) persons who likes a strong, independent central bank with a clear mandate towards low inflation. Thus, I have been happy with the European Central Bank and its “unambiguous primary mandate” to secure “inflation close to but below 2% in the medium term”.

This happiness has now changed to concern. Back in July 2021, the ECB changed its monetary policy strategy and now aims at a target of 2% inflation, a target that is symmetric (i.e. 3% inflation and 1% inflation are equally bad; previously 3% was worse than 1%). This may not sound like big potatoes but it is a loosening of monetary policy. More doveish, less hawkish.

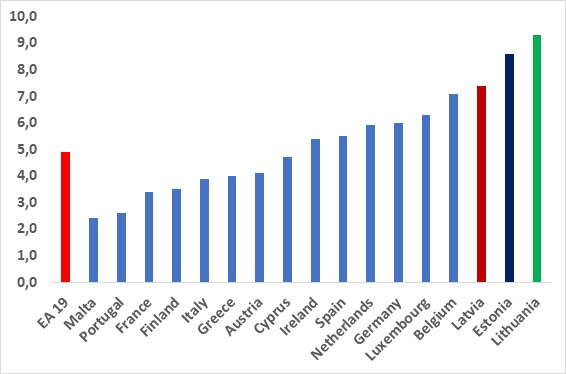

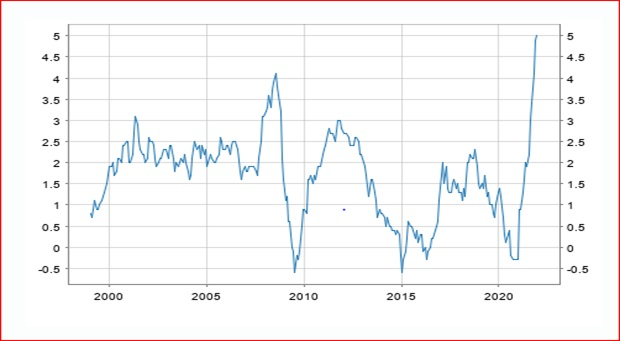

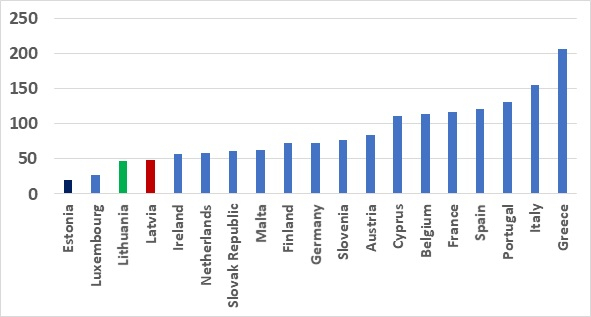

That current inflation is higher than 2% is a fact that I think everyone here is all too well-aware of, see Figure 1, but also the rate for the Eurozone as a whole is at an all-time high at 4.9% in November 2021, see Figures 1 and 2. Price stability?

Figure 1: Inflation rates in the Euro Area (EA 19) and its member states, November 2021

Source: Eurostat

Figure 2: Inflation in the Eurozone, 1999-I – 2021-XII

Source: ECB

True, the ECB is not supposed to act vis-à-vis current inflation but rather inflation in the “medium term” and this, according to ECB projections will come down during 2022.

Perhaps – but in the United States, facing similar inflation problems (OK, more pronounced), fear of entrenched inflation is seemingly changing monetary policy towards tightening a lot sooner than previously expected. Interest rate hikes to combat inflation may be enacted quite soon there.

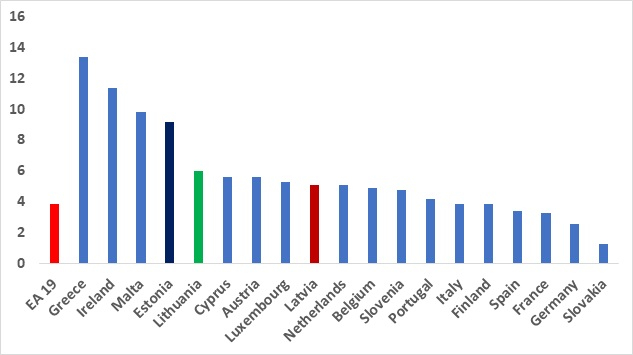

And does the Eurozone really need ultra-low interest rates to continue to stimulate the 19 economies of the zone? Growth is positive in every single of the 19 countries, see Figure 3, and in some countries red-hot. Some Estonians may think that 2007 has come back to haunt them…

Figure 3: Growth rates in the Eurozone and its member countries, year-on-year, Q3 2021

Source: Eurostat

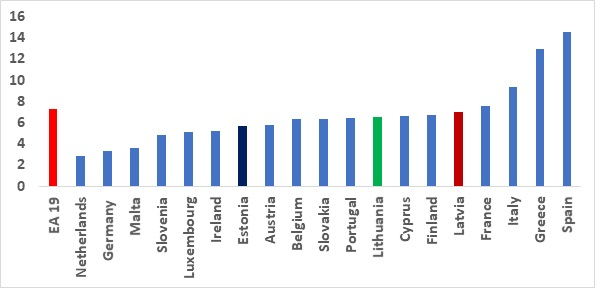

Unemployment rates are also at comparatively very low levels across the zone (double-digit unemployment rates are sadly a common feature in Greece and Spain; at 7% the Latvian rate is high by EU standards but low by historical Latvian standards). If such low rates of unemployment feed into a wage-price spiral, more inflation trouble is in the offing. Add to this that the EU’s Recovery and Resilience Fund is starting to operate. It adds as fiscal stimulus but I find it hard to see where to find the hands for all the work to be done with this money shall be found in the countries to the left in Figure 4 – and including Latvia where lack of available labour is an issue in some sectors already now.

Figure 4: Unemployment rates in the Eurozone (EA 19) and in the Eurozone member states, October 2021

Source: Eurostat

So, by my rather conservative way of viewing monetary policy, I think the ECB is taking significant risks in terms of inflation and there seems (my interpretation; can be wrong or right) to have been a change of power at the ECB over the years. A more hawkish North (Germany, Netherlands, Finland, Baltics (?)) have lost to a more doveish South. None of the three previous German members of the ECB’s Executive Board (Jürgen Stark, 2006-2011; Jörg Asmussen, 2012-2014; Sabine Lautenschläger) chose to complete their eight-year terms and in October 2021, Jens Weidmann, head of the German central bank, Bundesbank, chose to step down although he was just two years into his second term. Known as Mr “Nein zu allem” (Mr “No to everything”) he had often been against the prevailing monetary policy of the ECB, just like the three Executive Board members.

At the start of the Eurozone it was thought (certainly by me) that Germany would mostly get it its way – but in terms of monetary policy (again, my personal view), Germany & Co lost while Italy and Co won.

What’s in it for the winner? With ultra-low interest rates the ECB is effectively holding its hands under indebted countries of the South, see Figure 5.

The ECB as hostage to its own monetary policy decisions? More focus on salvaging the Southern economies than maintaining low inflation?

I think one can be forgiven for such thinking.

Figure 5: Gross government debt, % of GDP, 2021 (estimate), Eurozone countries

Source: IMF

…. and, thus to monetary hawks like myself I am not as convinced about the promises of the ECB as I used to be.

Morten Hansen is Head of Economics Department at Stockholm School of Economics in Riga and Vice-Chairman of the Fiscal Discipline Council of Latvia.

Points of view expressed here are not necessarily those of the Fiscal Discipline Council.